- Microsoft pauses or delays data centre projects in the UK, US, and Indonesia.

- Rivals Oracle and OpenAI ramp up investments.

Microsoft is scaling back or delaying data centre developments in several countries, including Indonesia, the UK, Australia, and in certain US states, as it reassesses strategy.

According to individuals familiar with the matter, ongoing talks and planned builds have been paused in North Dakota, Illinois, Wisconsin, the UK midlands and Jakarta, Indonesia. The pullback comes amid questions about whether expected demand for AI services can support the pace and cost of Microsoft’s global data centre expansion.

Microsoft has acknowledged changing its strategy but declined to provide details about specific projects. “We plan our data centre capacity needs years in advance to ensure we have sufficient infrastructure in the right places,” a Microsoft spokesperson said. “As AI demand continues to grow, and our data centre presence continues to expand, the changes we have made demonstrates the flexibility of our strategy.”

Some of the shelved plans include a site near Chicago, and a proposed lease near Cambridge in the UK for a facility to host Nvidia hardware. Microsoft has also paused work at a site in Mount Pleasant, Wisconsin, where development has already cost US$262 million, according to documents reviewed by Bloomberg.

In Jakarta, parts of a data centre campus have been placed on hold. Elsewhere, Microsoft has walked away from a proposal to acquire more capacity from cloud infrastructure company CoreWeave. CoreWeave’s CEO Michael Intrator confirmed the decision, but did not specify which locations were affected.

In other cases, negotiations have slowed rather than stopped. At a server farm in North Dakota originally earmarked for Microsoft, discussions stalled until an exclusivity clause lapsed. Applied Digital, the data centre operator, has since found other tenants and secured funding to proceed with development.

At Ada Infrastructure’s Docklands site in London, Microsoft was in talks for about leasing 210-megawatt of capacity, but has is holding off on committing. The site is now being shown to other potential tenants, according to sources familiar with the matter.

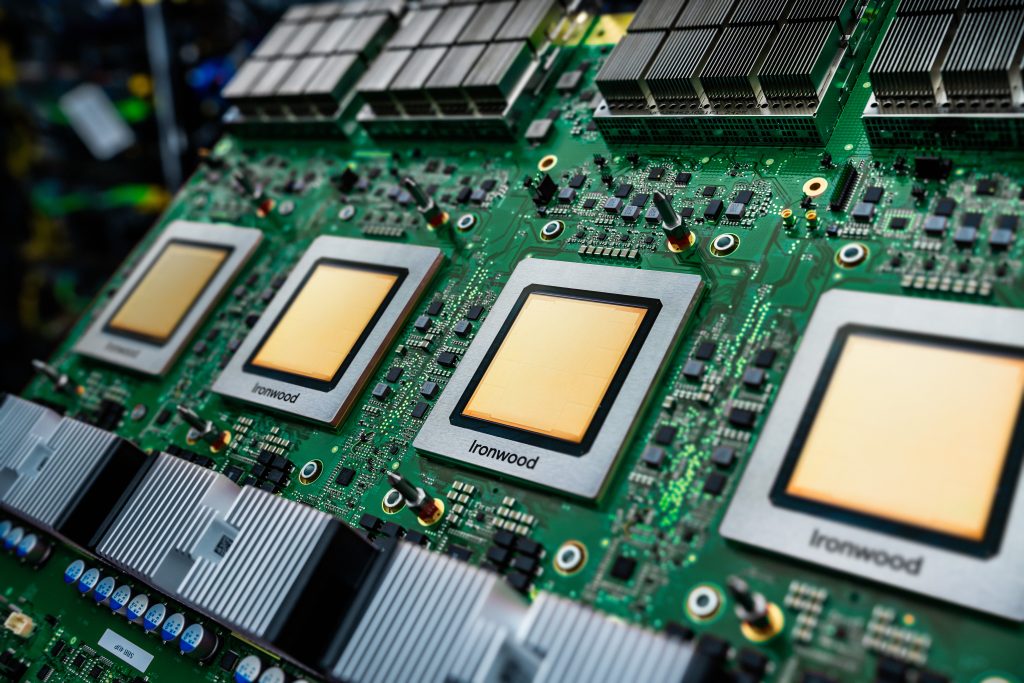

Microsoft says it remains committed to key projects, which include a US$3.3 billion facility in Wisconsin and the launch of the Indonesia Central cloud region in mid-2025. It has maintained that it will spend roughly US$80 billion on data centre buildouts in its current fiscal year but signalled a shift in its next fiscal year toward equipping existing sites rather than construction of new data centres.

While Microsoft is re-evaluating, other firms are pressing on with large-scale infrastructure. OpenAI, Oracle, and SoftBank have announced joint venture Stargate, which aims to invest up to US$500 billion in AI infrastructure in the US. Stargate’s first phase includes a US$100 billion deployment in Texas, intended to support large-scale AI development.

The contrast in strategy between competing hyperscalers has drawn attention from investors and analysts. TD Cowen reported that Microsoft has abandoned projects amounting to two gigawatts of electricity capacity across the US and Europe. The firm suggested this may indicate a mismatch between expected demand and Microsoft’s existing capacity. Analysts also speculated that OpenAI may be shifting workloads from Microsoft to Oracle.

The change in infrastructure strategy is also being influenced by developments in the technology. Chinese AI firm DeepSeek claims it can deliver competitive AI performance using fewer resources, raising the possibility that future AI systems may require less computing power than originally anticipated.

At the same time, Microsoft’s adjustments may reflect external constraints. In cities like Dublin and Amsterdam, data centre growth has been met with tighter regulation due to concerns over electricity consumption and environmental sustainability. Dublin has limited new grid connections for data centres, while Amsterdam previously paused all new development to address strain on local resources.

Industry observers say hyperscalers are increasingly shifting focus to projects that can deliver results more quickly and cost-effectively. “You may have initially thought one data centre project would be the fastest speed to market, but then you realise that the labour, supply chain and power delivery wasn’t as quick as you thought,” said Ed Socia, director at datacentreHawk. “Then you would have to shift in the short term to focus on other markets.”

CoreWeave’s Michael Intrator said that Microsoft’s retreat appears to be specific to its situation. “It’s pretty localised, and their relationship with OpenAI has just changed,” he said.