- China’s semiconductor dominance extends to memory chips, where South Korean Samsung and SK Hynix led.

- Despite US export tariffs, China ranks second globally in memory technologies.

China’s semiconductor prowess is becoming increasingly evident in important technology sectors, So reveals a recent report by the Korea Institute of Science and Technology Evaluation and Planning (KISTEP).

The South Korean think tank’s research indicates China has surpassed South Korea in foundational capabilities across nearly all semiconductor technology areas, including the memory sector, where South Korean firms have traditionally been global leaders.

KISTEP findings reveal a shifting semiconductor landscape

The KISTEP report is based on a survey of 39 South Korean semiconductor experts conducted in 2024, and highlights a significant shift in the global semiconductor landscape. According to the findings, China now outranks South Korea in memory chip technologies, where South Korean giants Samsung Electronics and SK Hynix have maintained dominance for a generation.

China now ranks second globally, trailing only the US in the sector. The change marks a substantial difference from KISTEP’s previous findings published in 2022, when South Korea held the second position after the US in the memory and advanced packaging technology sectors. China ranked third and fourth in these areas at that time, respectively.

“Even in the memory market, where Korea had maintained its unrivalled status, Chinese semiconductor companies are increasing their market share,” states the latest KISTEP report, adding that China is ramping up production of legacy chips “with little technology gap” compared to industry leaders.

Measuring China semiconductor dominance: technology scores and capabilities

The detailed evaluation conducted last year reveals that China’s high-density resistive memory technology scored a ranking of 94.1% (with 100% representing the highest level), outperforming South Korea’s 90.9%. This statistic is particularly noteworthy as memory technology has been South Korea’s most substantial semiconductor sector to date.

The report further demonstrates China’s advance in multiple semiconductor domains. In high-performance and low-power AI semiconductor technology, China scored 88.3%, exceeding South Korea’s 84.1%. It registered 79.8% for power semiconductors, significantly surpassing South Korea’s 67.5%, and in next-generation, high-performance sensing technology, China achieved 83.9% compared to South Korea’s 81.3%.

The two countries achieved parity only in advanced packaging technology, with both scoring 74.2% in foundational capabilities. However, Taiwan leads in semiconductor advanced packaging technology commercialisation, while the US dominates all other technology sectors in both foundational capabilities and commercialisation perspectives.

The KISTEP report also evaluated the technological lifecycle of the semiconductor sector, noting that South Korea maintains an advantage in process and mass production, while China excels in foundational capabilities and design. The report identifies South Korea’s foundational capabilities and design technology as the weakest links in its semiconductor life cycle, ranking lowest among evaluated countries.

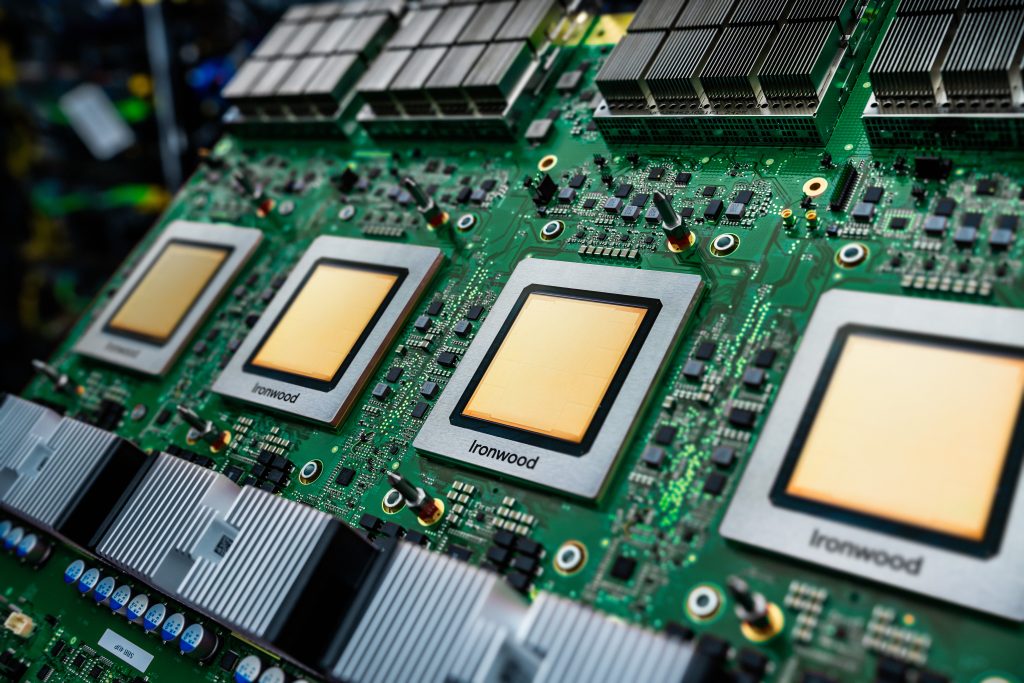

Chinese memory manufacturers have been making significant strides in narrowing technology gaps with global industry leaders. ChangXin Memory Technologies (CXMT), a dynamic random access memory (DRAM) chip producer, has developed consumer-grade chips using 16-nanometer processing technology.

While still behind the 12-nm and 14-nm nodes used by Samsung, SK Hynix, and US-based Micron Technology in DDR5 memory production, the progress represents the closing of the technological divide. Growing Chinese semiconductor dominance comes despite extensive US export restrictions limiting China’s access to advanced chips and chip-making technologies. In response to those challenges, Beijing has implemented what observers call a “whole nation” approach to achieving semiconductor self-sufficiency, including establishing the country’s largest-ever chip investment fund last year.

Challenges and opportunities in the global chip race

The report highlights concerns about the impact of geopolitical tensions on South Korea’s semiconductor industry, including “the risk of Korea’s exports falling or being forced out of the Chinese market due to US export controls.” Other challenges identified include the exodus of core talent, intensifying competition in AI semiconductor technology, South Korea’s domestically focused policies, and rapid shifts in supply chains.

The findings represent a serious situation for South Korea, which has built much of its economic success on its leadership in the semiconductor market. To maintain its high-ranking position, the country must address its foundational capabilities and design technology shortcomings.

Taiwan remains a leader in advanced packaging technology commercialisation, while the United States continues to lead in overall semiconductor technology, both in foundational capabilities and commercialisation. However, China’s rapid advancement despite well-publicised international restrictions demonstrates the effectiveness of its focus and its national strategy to achieve technological self-sufficiency.

As China’s domestic semiconductor industry develops, particularly in memory technologies (which have traditionally lagged behind), the global semiconductor landscape is experiencing a significant realignment. The China semiconductor dominance emerging in foundational capabilities suggests that despite export controls and various restrictions imposed on the market, the country is making substantial progress toward its goal of technological self-reliance.