- Google plans to acquire cybersecurity company Wiz.

- Deal is expected to strengthen Google’s cloud security capabilities.

Google plans to acquire cybersecurity company Wiz for $32 billion in its largest-ever acquisition, strengthening the US giant’s position in the highly-competitive cloud computing market. If the deal is approved, Wiz will be integrated into Google Cloud, which generated $43.2 billion in revenue last year, up 64% from 2022.

The deal comes as Google faces antitrust inquiry in the United States, and lawsuits targeting its advertising practices and search engine dominance. Google’s acquisition of Wiz reflects a broader industry trend in which organisations seek to expand their cloud security capabilities in response to growing demand for data-intensive services.

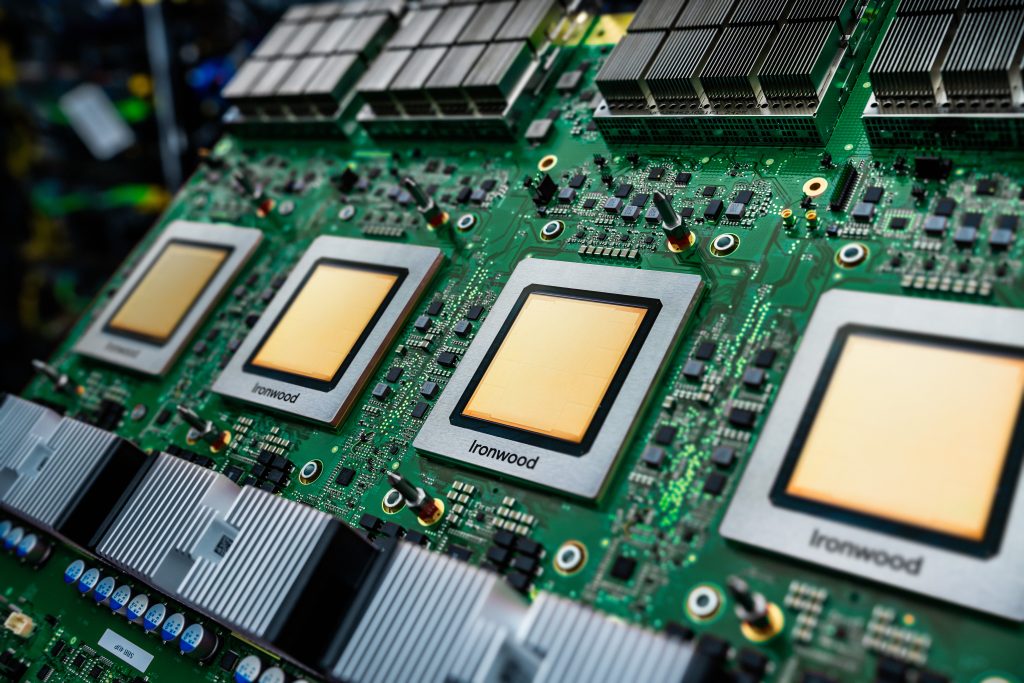

Google’s push into cybersecurity

Google’s proposed acquisition of Wiz aims to strengthen its position in cloud, where it trails in third place behind Amazon and Microsoft.

Wiz, founded in 2020, has quickly become a major player in cloud security, obtaining contracts with large organisations to monitor and manage cloud vulnerabilities.

Wiz CEO Assaf Rappaport said the company shares Google’s goal of making cloud security more accessible and effective. “Wiz and Google Cloud are both fueled by the belief that cloud security needs to be easier, more accessible, more intelligent, and democratised, so more organisations can adopt and use cloud and AI securely,” they said in a blog post. Google CEO Sundar Pichai stated that the acquisition would let the company provide stronger security at a lower cost.

Wedbush analysts have described the deal as a strategic move to compete with Microsoft and Amazon, which have already invested heavily in cybersecurity. Google’s acquisition of Mandiant for $5.4 billion in 2022 helped boost its cloud division’s operating profit to $6.1 billion last year, and Wiz is expected to expand its portfolio of offerings.

High price and market impact

The $32 billion price tag exceeds Google’s previous largest deal – a $12.5 billion acquisition of Motorola Mobility in 2012. According to Mergermarket, the Wiz deal ranks among the 20 most expensive software company acquisitions to date. Investors have responded cautiously, with Alphabet’s shares dropping 2% following the announcement.

Google has been in discussions with Wiz for several months, reportedly increasing its offer from a previous $23 billion bid that was rejected in July. Wiz initially planned to pursue an IPO but decided against it owing to market volatility.

Industry-wide impact and antitrust concerns

The acquisition comes as the cybersecurity market continues to grow. Mark Smith, a director at Houlihan Lokey’s Technology Group, said the global cybersecurity market exceeds $50 billion, growing over 10% annually. Cloud security, in particular, is expanding even faster due to increasing threats and regulatory demands. “Strategic acquirers are competing to secure emerging technologies, driving up valuations,” he said. He highlighted AI’s role in shaping security measures and creating more resilient defences.

The Google-Wiz deal raises antitrust concerns. The US Justice Department has already filed cases against Google’s search and advertising businesses, threatening to force the company to divest itself of Chrome and/or Android. It’s thought, therefore, that regulators are expected to scrutinise the Wiz acquisition closely. The Justice Department is also exploring the impact made by Google’s deals to make its search engine the default for Apple and other platforms.

Despite these challenges, Google and Wiz anticipate the deal will close in 2026, pending regulatory approval and completion of other conditions. Analysts at Mergermarket believe the companies would not have agreed to the deal without seeing a clear path to approval under the Trump administration.

Business watchdog group, the Demand Progress Education Fund, has urged regulators to block the deal, arguing it would consolidate too much power in Google’s hands. Emily Peterson-Cassin, the group’s director of corporate power, said the acquisition would undermine competition in the cybersecurity market.

Future of cloud and cybersecurity

The Wiz deal reflects the trend of consolidation in the cybersecurity space. Google, Microsoft, and Amazon are investing heavily in cloud security to address rising threats and meet customer expectations for compliance and protection. According to Wedbush analysts, more deals will likely follow as organisations seek to boost their AI and security capabilities under a receptive US administration.

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with other leading events including Intelligent Automation Conference, BlockX, Digital Transformation Week, and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.