- AIST and Intel building Japan’s first EUV semiconductor research centre.

- The partnership with Japan is to reduce dependence on foreign semiconductor facilities.

Japan’s National Institute of Advanced Industrial Science and Technology (AIST) is partnering with US chipmaker Intel to build a semiconductor research centre.

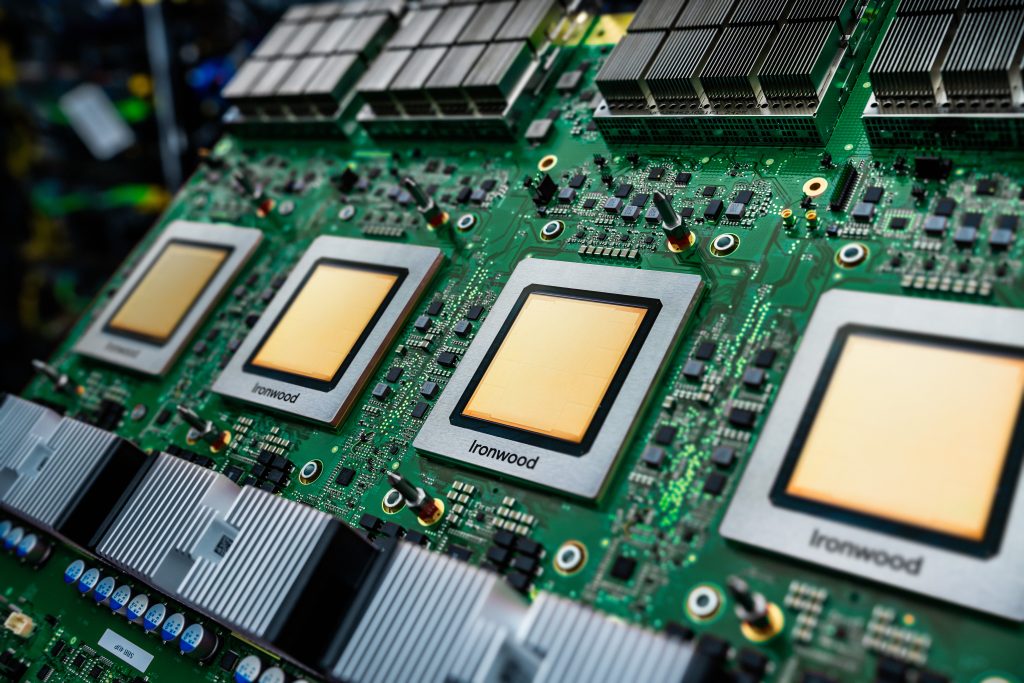

The facility, expected to be completed within three to five years, will focus on extreme ultraviolet (EUV) lithography, essential for producing semiconductors at the 5-nanometer scale and smaller. This will be the first centre in Japan where several businesses will have the opportunity to use EUV equipment for prototyping and testing.

AIST will operate the facility under Japan’s ministry of economy, trade, and industry, while Intel will contribute its expertise in EUV-based chip manufacturing. The project’s investment is estimated to reach hundreds of millions of dollars. EUV technology is important for enhancing chip performance, which involves the ability to place numerous transistors on smaller chips. Given that each EUV machine costs more than 40 billion yen ($273 million), accessing this technology can be quite challenging for individual companies.

Until now, Japanese companies have had to rely on overseas facilities, such as Belgium’s Imec research centre, to access EUV equipment. With the new centre, Japan can conduct advanced semiconductor research domestically, without depending on foreign institutions. This development is particularly significant in light of the increasing restrictions on the export and cross-national use of EUV-related technology, driven by US-China tensions. It underscores the current focus on localising critical technology rather than relying on foreign providers.

ASML Holding of the Netherlands dominates the EUV equipment market, but chip production involves over 600 specialised processes. Japan, home to major semiconductor companies like Lasertec and JSR, which lead in EUV inspection and EUV materials production, will benefit greatly from cooperation with Intel. Strengthening ties between Intel and Japanese semiconductor equipment suppliers will help Japan boost its long-term innovation capacity which has yet to return to the heady days of the so-called Asian Tiger period of the 1980’s.

Relationship between Intel and Japan

Beyond EUV, Intel has announced a partnership with 14 Japanese companies to automate the back-end chipmaking processes including packaging. Back-end processes are becoming as important as front-end processes, which involve stacking chips to improve performance, as chip manufacture approaches physical limits. The partnership, which includes companies like Omron, Yamaha Motor, Resonac, and Shin-Etsu Polymer, will be led by Kunimasa Suzuki, head of Intel’s Japanese division. The partners plan to invest billions of yen and develop automated back-end technology by 2028.

Automation is viewed as key for shifting chip production to higher-cost regions like Japan and the US, where labour shortages and rising expenses present challenges in manual assembly production lines. Intel and its partners will construct a trial back-end production line in Japan, planning for full automation that could also mitigate the country’s shortage of chip engineers, a problem exacerbated by competition from firms like Taiwan Semiconductor Manufacturing Co. (TSMC) and Rapidus.

Japan is a key player in the global semiconductor supply chain, accounting for about a 30% share of production equipment and almost 50% of materials. The Japanese government decided to provide the industry with additional support to boost domestic semiconductor development, allocating 4 trillion yen ($26 billion) from 2021 to 2023 alone. In April of this year, 53.5 billion yen in aid was approved for Rapidus, an organisation attempting to start mass production of the next generation of semiconductors. The government is also considering potential incentives for foreign companies to participate in the local semiconductor ecosystem.

A similar context frames the cooperation between Japan and the US which aims to reduce geopolitical risks in the semiconductor supply chain. Since the final production stage, or back-end, is currently concentrated in China—accounting for 38% of global capacity—localising production to avoid potential disruptions is becoming increasingly important for maintaining competitiveness.

In addition to Intel, other semiconductor giants, namely TSMC and Samsung Electronics, are opening research centres in Japan to focus on producing back-end chips. Market analysts also predict that the global back-end chip market will grow by 13% and reach $12.5 billion value in 2024.