- US-China trade war intensifies as Beijing unveils targeted countermeasures worth $20 billion.

- Includes rare metal restrictions and Western tech company probes.

- Global markets brace for impact of new rounds of tariffs and economic sanctions.

The latest escalation in the US-China trade war has sent shockwaves through global markets as Beijing unveiled a calculated series of retaliatory measures against American businesses, marking a significant intensification of economic tensions between the world’s two largest economies.

The Chinese government’s response, triggered by President Trump’s blanket 10% tariff on Chinese imports, demonstrates a sophisticated approach to economic warfare by the Chinese. Its measures target strategic sectors from technology to rare earth metals with careful calibration of their impact on domestic markets.

Strategic targeting of American business interests

Beijing has said it will introduce a 10% tariff on US agricultural machinery and a 15% charge on crude oil imports, which will likely pressure specific US sectors rather than wage all-out economic warfare.

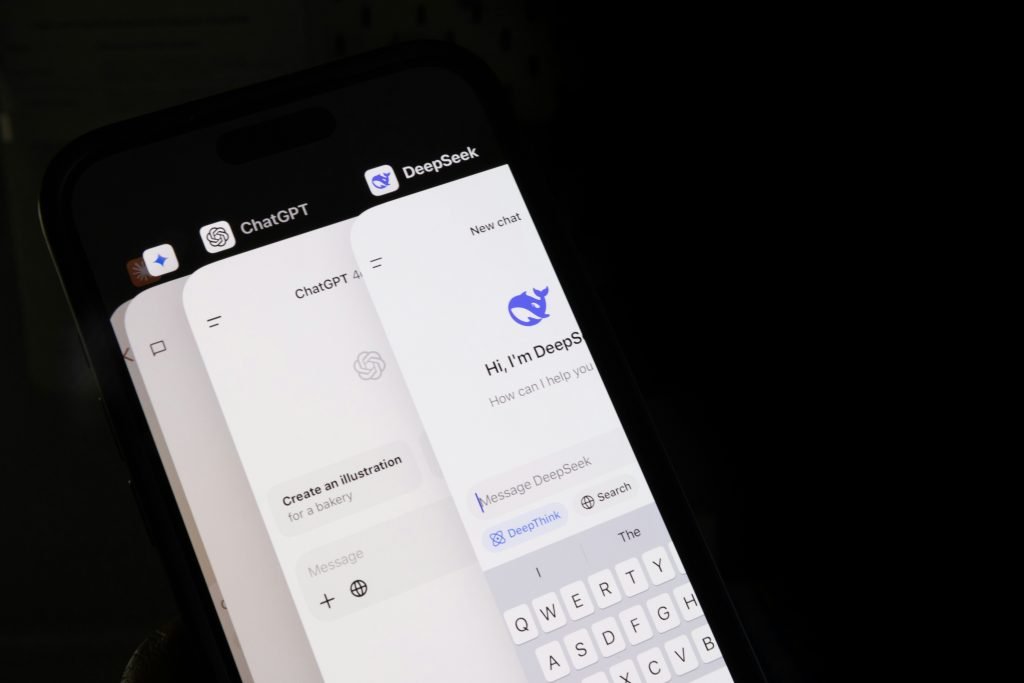

The measured approach is particularly evident in China’s targeting of US tech giant Google through an anti-monopoly investigation, despite the company’s limited presence in the Chinese market since 2010. The energy sector measures are more noteworthy, with China imposing a 10% tax on liquefied natural gas (LNG) imports from the US. While China has been increasing its LNG imports from America, with volumes nearly doubling since 2018, the overall impact will be limited.

US imports account for just 1.7% of China’s total crude oil purchases from abroad, suggesting Beijing has chosen its targets carefully, as ones that won’t significantly disrupt domestic energy security. China’s strategic calculation is further reinforced its existing strong energy relationships with alternative supplying countries, particularly Russia, where it has secured oil at discounted rates.

Rare metals and resource control

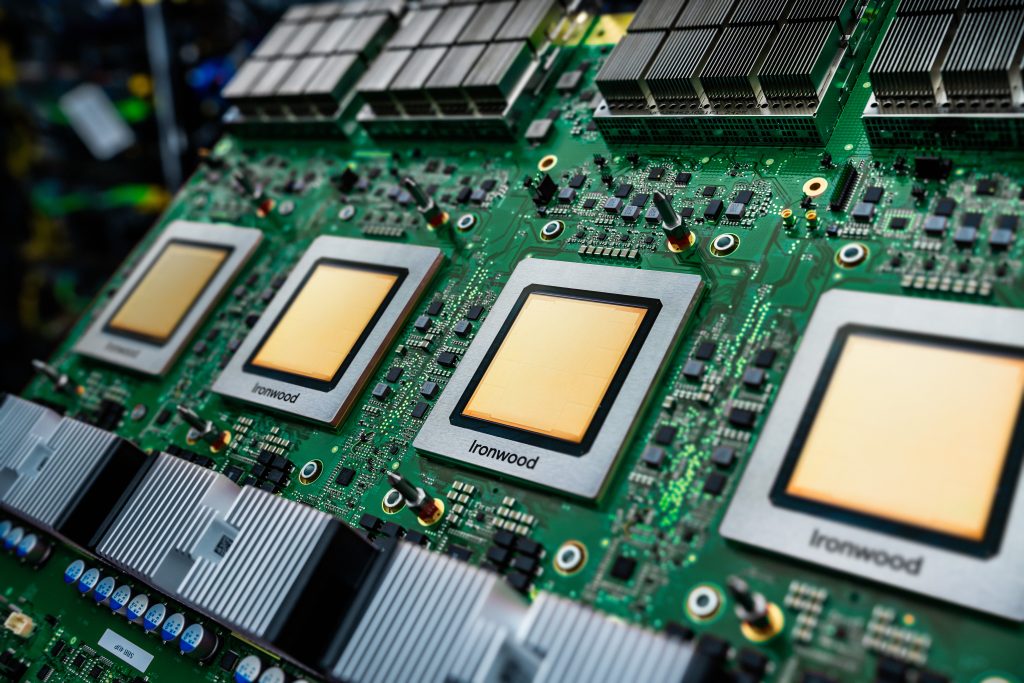

The most significant aspect of China’s response lies in its restriction of rare metal exports, which will have far-reaching implications for global supply chains right across the technology sector. With China controlling approximately 90% of global refined rare metal output, imposing export controls on 25 important metals, such as tungsten, could affect everything from aerospace technology to consumer electronics.

The timing of President Trump’s subsequent overture to Ukraine for rare earth metals supply, in exchange for $300 billion in support, underscores the significance of this particular countermeasure.

The automotive sector has not been spared, with China implementing a 10% tariff on pick-up trucks and large cars made in the US. However, this measure’s impact may be limited given China’s relatively low import volume of American vehicles and its established automotive trade relationships with European and Japanese manufacturers.

Beijing’s strategy consistently targets sectors where alternative suppliers are readily available to it. In a move that signals Beijing’s willingness to use regulatory power as a trade weapon, the addition of PVH, owner of Calvin Klein and Tommy Hilfiger, to China’s ‘unreliable entity’ list represents a deliberate targeting of American consumer brands. The designation could lead to difficult challenges for these companies in the Chinese market, including potential fines, regulatory investigations, and complications with employee visas.

The Chinese policies mirror similar actions the US took through its entity list, highlighting the increasingly complex interplay between trade policy, regulatory oversight, and jingoism. Agricultural machinery tariffs deserve special attention. They align with China’s broader strategy of reducing dependence on foreign technology while building domestic capabilities. In recent years, China has significantly increased investments in the sector, making these tariffs more about protecting and promoting domestic industry than punishing US manufacturers.

The dual-purpose approach characterises much of Beijing’s response to US trade pressure. According to a research note by Julian Evans-Pritchard, head of China Economics at financial insight firm Capital Economics, China’s targeted measures affect approximately $20 billion worth of annual imports, representing about 12% of China’s total imports from the US. While this appears modest compared to the US’ $450 billion worth of targeted Chinese goods, Beijing’s selective response suggests a strategic approach aimed at maximising impact while maintaining economic stability.

Global implications and future outlook

The global implications of the trade dispute extend beyond bilateral relations. Restricting rare metal exports could create ripple effects throughout global supply chains, affecting industries from consumer electronics to defence manufacturing.

The global business community will watch closely as both nations prepare for potential negotiations, with Trump announcing plans to speak directly with Chinese President Xi Jinping.

The scheduled implementation of China’s measures on February 10 is a deadline that will reveal either a diplomatic breakthrough or a further deterioration in US-China trade relations. The current escalation represents more than just a trade dispute; it reflects deeper tensions between the world’s two largest economies as they navigate issues of technological supremacy, economic security, and global influence.

As this new chapter in the US-China trade war unfolds, one outcome may well be different speeds of innovation in an industry that has always used the word ‘global’ when discussing the rapid speed of technological change.