| Getting your Trinity Audio player ready... |

- The Biden administration plans to put YMTC and more than 30 other Chinese companies on a trade blacklist as early as this week.

- Companies on the Entity List are blocked from buying technology from US suppliers unless they get a special export license from Commerce.

- The move, according to analysts, could see YMTC’s production hindered and technological progress capped.

On October 7, China’s top flash memory maker, Yangtze Memory Technologies Co (YMTC), was added to the United States’ (US) ‘Unverified List’ — a trade watch list by the US Bureau of Industry and Security (BIS). Two weeks later, YMTC issued a statement highlighting its compliance “across the globe”. After all, the Chinese giant is estimated to control 5 to 6% of the global NAND flash memory market.

Fortunately, it was told that the company can be removed from the list if it provides the US government with more details about the end users of its products. If it does not comply, it will be added into the Commerce Beureu’s Entity List, subjecting it to strict US export controls. However, according to a person familiar with deliberations, the Biden administration plans to put YMTC on the trade blacklist as early as this week.

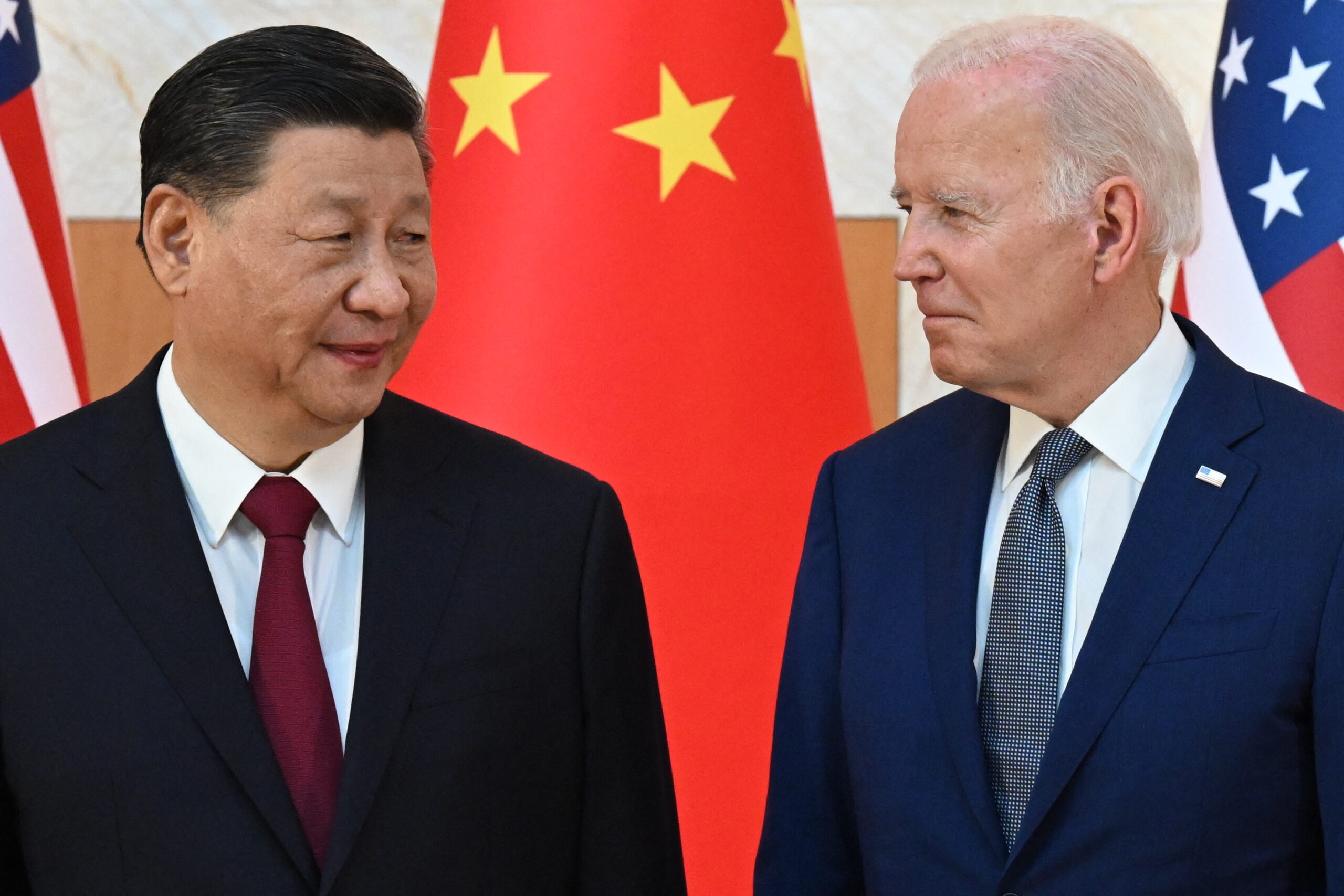

But YMTC won’t be the only one — it’ll be accompanied by more than 30 other Chinese companies that the BIS added to its Unverified List on October 7. Considering YMTC is the biggest player in China’s flash memory market, it was the most high-profile company in the latest batch of Chinese entities, a move that would deepend tensions between the world’s two economic superpowers.

To put things into context, companies on the Entity List are blocked from buying technology from US suppliers unless they get a special export license from Commerce. It is the very list that actually decimated Huawei Technologies Co.’s consumer smartphone business and hampered the efforts of Semiconductor Manufacturing International Corp. to grow into China’s chipmaking champion.

The US has “politicized and weaponized economic cooperation,” Chinese Foreign Ministry spokesman Wang Wenbin said Wednesday at a regular press briefing in Beijing, adding that Washington’s actions disrupted supply chains. China would take steps to protect the rights of its companies, he said.

The same month when YMTC and other companies were put on a list for further scrutiny, the Biden administration unveiled a sweeping set of restrictions on China’s ability to buy semiconductors and chip making equipment. The US is basically seeking to hinder Chinese economic dynamism and military muscle alike. Frankly, the export controls announced in October wasn’t the first time Washington has used its influence on semiconductor supply chains as a geo-economic weapon.

Beginning under President Donald Trump, Washington sought to kneecap mainly the Chinese tech behemoth Huawei Technologies Co. by denying it the cutting-edge chips it needed to dominate the world’s 5G telecommunications networks. But as Bloomberg puts it, “that was a very targeted denial campaign meant to cripple a specific company that represented an extraordinary national security threat.”

Biden’s approach is broader: It is technological containment, pure and simple. “President Joe Biden’s administration will use an obscure but potent regulation, the Commerce Department’s Foreign Direct Product Rule, to prohibit firms from providing certain advanced semiconductors to Chinese companies unless they secure permission from Washington,” a Bloomberg report stated.

Overall, what clearly appears is that the US is targeting to maintain a technological lead over China. That has largely led to the capping ofChina’s logic chip-making advancements at the 14-nanometre node process and DRAM and NAND flash at 18nm and 128 layers, respectively.

What’s next for YMTC?

Although YMTC was a latecomer to the NAND flash industry, it raced ahead to become a leading company in the market. A recent TechInsights report credited YMTC with producing “232-layer NAND Flash, ahead of its rivals”, making the Chinese firm a “serious contender” with global giants such as Micron, Samsung and SK Hynix.

That said, the current Entity List rules require tools capable of producing 128-layer NAND flash chips to be approved for export. Speaking to South China Morning Post (SCMP), TechInsights’ vice-chair G.Dan Hutcheson noted that “Adding YMTC to the Entity List will not bring down its current production completely. But it will hinder production and product development due to restricted access to US suppliers.”

On the other hand, Los Angeles-based SemiAnalysis’ chief analyst Dylan Patel said YMTC will still be able to produce for a while due to many spare tools, “but its technology will be capped at 128-layer.” YMTC had also been in talks to supply Apple Inc., which would have marked a significant step for China’s tech industry, but that has since been put on hold since the US imposed tighter export controls against Chinese technology companies.